Right Approach Augmented with Advancing Technology is the Key to Biomedical Innovations

For formulation research scientist Mallesh Kurakula, the excitement of research lies in unwrapping the small-scale advances that have inherence to lead to big breakthroughs.

“Majority of my doctoral and postdoctoral research tasks were focused on understanding stages of drugs from discovery to designing strategies to deliver high safety and efficacy”. Dr. Mallesh explains “During my Ph.D. I was actively working on the Utilization of Biodegradable Smart Polymers to Develop and Evaluate Thermosensitive Hydrogel-based Nanocrystals for Control Drug Delivery of Statins (Atorvastatin) for Enhanced Anti-Hyperlipidemic activity”. The research project being successful was published in high impact factor ISI indexed journals that received great citations from the scientist across the globe1,2.

Dr. Mallesh also adds few insights on his current exciting and challenging project at the University of Memphis, TN, USA. “The world suffers from a shortage of new antibiotic discovery and limitation of existing drugs failing to reach their therapeutic outcomes and their intended use. The concept of drug repurposing is a grey area that is gaining momentum especially during this COVID-19 times,” Kurakula says. “Reorienting existing classical statin drugs to unmet clinical needs such as bone regenerative medicine paves the way as a new therapeutic indication that is thought-provoking and thrills me visualizing it’s impact on clinical effectiveness.”

Kurakula says it was his passion for the development of multitargeted biomedical and pharmacotherapy approaches as feasible treatments for patients with neuromuscular disorders- such as spinal cord injuries or bone defects or diseases- that made him realize the importance of applied biomedicine research. On average there are 2 million traumatic extremity bone injuries resulting from road mishaps and military wars that impedes an individual life. Apart from grafting procedures, still, there is a growing concern for unfulfilled treatment options that aid faster bone regeneration. Dr. Kurakula adds “ To overcome this problem, we are working to repurpose statin (Simvastatin-SMV) and locally deliver as an alternative to BMP-2 for inhibiting osteoclast, activating Vascular Endothelial Growth Factor (VEGF) and Tumor Growth Factor- β (TGF-β) that are important to bone healing processes via state of the art electrospun chitosan membranes (ESCM) as guided bone regeneration membrane (GBR). These GBR will be administered as an implantable medical device (Class III) that will be an effective adjunctive therapy for further stimulating bone formation, especially in large traumatic craniomaxillofacial defects”3. These medical devices are developed in-line with strict regulatory guidelines of the USA (FDA, ASTM), European countries.

“Extensive understanding of the in-vitro and in-vivo models for bone regeneration could help us determine the possible pharmacological targets that can be tested for bone and tissue regeneration purposes,” Kurakula Says.

Kurakula credits some of his research success so far to his mentors while working across Europe, the USA, and the Middle East, whose experiences, advice support helped Kurakula to realize his passion, overcome challenges in translating research into commercially viable products, particularly Prof. Joel D Bumgardner.

“I admire Prof. JDB for helping me to shape into a better professional, one who can deliver any work with passion, patience, and perseverance,” Kurakula says. And it is that passion that propels him inside and outside the laboratory.

“I relish drenching the mind and body in research to investigate unique biomedical questions and find logical, evidence-based answers,” Kurakula says. “However, outside the lab, I’m an idealist who constantly wants to explore the additional possibility of designing simple, cost-effective, and safe regenerative medicine that has a broad impact on an individual lifestyle”.

Notable highly cited publications* (Source: Google Scholar)

- Kurakula, M*., El-Helw, A.M., Sobahi, T.R. and Abdelaal, M.Y., 2015. Chitosan-based atorvastatin nanocrystals: effect of cationic charge on particle size, formulation stability, and in-vivo efficacy. International journal of nanomedicine, 10, p.321. https://doi.org/10.2147/IJN.S77731

- Kurakula, M. and A Ahmed, T., 2016. Co-delivery of atorvastatin nanocrystals in PLGA based in situ gel for anti-hyperlipidemic efficacy. Current Drug Delivery, 13(2), pp.211-220. https://doi.org/10.2174/1567201813666151109102718

- Murali, V.P., Fujiwara, T., Gallop, C., Wang, Y., Wilson, J.A., Atwill, M.T., Kurakula, M., and Bumgardner, J.D., 2020. Modified Electrospun Chitosan Membranes for Controlled Release of Simvastatin. International Journal of Pharmaceutics, p.119438. https://doi.org/10.1016/j.ijpharm.2020.119438

Author Bio

Dr. Mallesh Kurakula

Department of Biomedical Engineering,

The Herff College of Engineering,

The University of Memphis, TN, USA 38152

Email: mkrakula@memphis.edu

Google Scholar: Google Scholar/mallesh-kurakula

LinkedIn: www.linkedin.com/in/mallesh-kurakula

Website: https://www.thejdblab.com/

Azure Pipeline caching- A Magical Wand – Pyramid Consulting

Pipeline caching can help reduce build time by allowing the outputs or downloaded dependencies from one run to be reused in later runs, reducing or avoiding the cost to recreate or redownload the same files again.

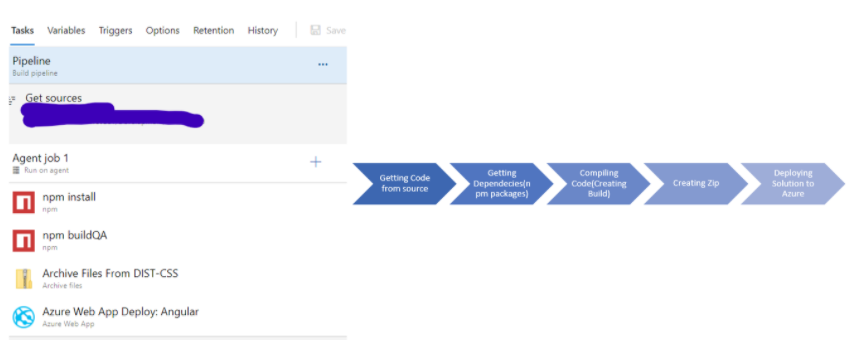

Recently, we at Pyramid Consulting started DevOps for our projects, one of the existing features on DevOps is CI/CD, and to implement the same we used the pipeline. Currently, we are using it in the Angular project, so the following are tasks we performed in Agent to deploy/build the code. So, let’s consider this as a default agent pipeline.

Now when we run this pipeline

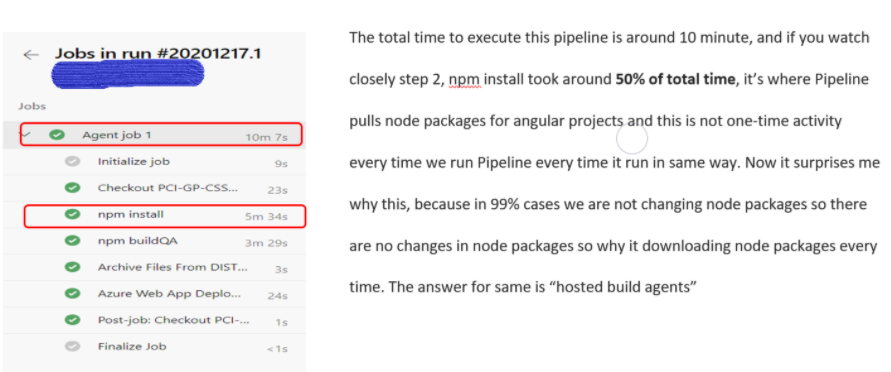

While using hosted build agents; each time a build is triggered a new VM is allocated thus any previously cached npm packages are lost. So, whenever the pipeline runs, it downloads the npm package before the build. This will spike the network and build cost, and we have also remembered the deployment is in DevOps is not fully free.

Now, the question is how can we overcome the same? There are a couple of ways to do this; one is Self-Hosted Agent and the other is Artifacts but the simplest and most effective what I feel in this scenario is “Cache Task” introduced by Microsoft.

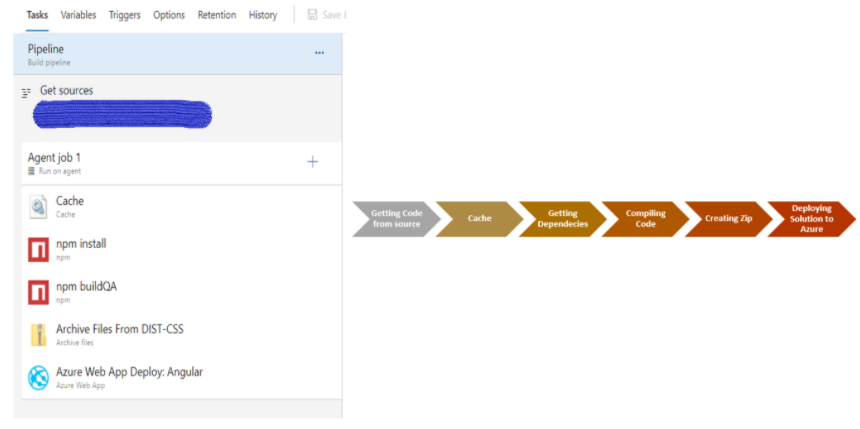

As Per Microsoft “Caching is especially useful in scenarios where the same dependencies are downloaded over and over at the start of each run” So we added “Cache Task” in our project and run the build again.

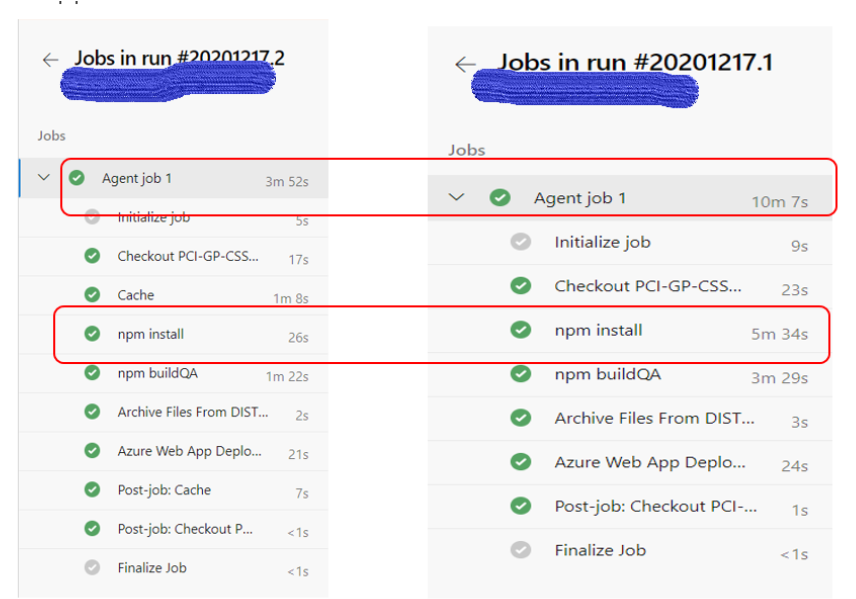

Now, if you compare with the earlier Pipeline, you will see one additional task “Cache” and configure the same. We will discuss configuration a little later, for now, let’s see what changes. When we run Pipeline, the very first time you don’t see any changes as we start caching initially and there won’t be any cache hence no changes in execution time.

Now comes the magic time, when you execute the pipeline a second time, now compare npm install from 5 minutes to 26 seconds and total pipeline execution time from 10 minutes to 3 minutes we save almost 70% time of build execution.

It is worth noting that caching is currently supported in CI and deployment jobs, but not in classic release jobs.

Insurance Technology Trends in 2020 | Pyramid Solutions

The latest technologies are changing the way customers interact with companies. Insurance Technology’s biggest drivers include Artificial Intelligence, Machine Learning, Big Data, IoT, Blockchain, and Digital Ecosystems. Insurers are already investing in Insurtech, but a large proportion of MGAs and agents in the industry remain untapped.

What is Insurtech? Why should we care about it?

According to Investopedia, Insurtech is all about using technology-driven innovations designed to boost savings and enhance efficiency from the current insurance industry model. In simpler terms, Insurtech is the amalgamation of Insurance & Technology.

In contrast to other markets, the have always been inclined to the traditional way of doing business, at least until recent years. Advances in insurance technology have given a platform to upcoming Insurtech startups to thrive in the industry.

Now let’s jump into some of the insurance technology trends of 2020 that are going to change the industry and also how you can use these trends for your benefit!

Insurtech Trend 1: Artificial Intelligence and Machine Learning

The insurance community traditionally has been slow to adopt new technologies. The disruption by digital mechanisms like AI and Machine Learning are slowly starting to redefine the essence of the insurance sector – customer relationship through trust and advice.

Big data and machine learning are technologies that are mostly used by insurers, not agents. These technologies allow insurers to provide their products and services online – through their websites, mobile applications, and even through texts.

The takeaway- insurance technology does not replace insurance agents but rather helps them provide better customer service.

Use Case for AI in the insurance Industry:

- Image Analytics

- Machine Learning in Underwriting (Automated Process of Claims)

- Process Automation of Data Intake

- Connected Claims Processing

- Chatbots and Virtual Agents

Use Case for ML in the insurance industry

- Lapse management

- Recommendation engine

- Assessor assistant

- Property analysis

- Fraud detection

- Personalized offers

- Experience studies

Insurtech Trend 2: Big Data & IoT

‘Customer Retention is the key to making your business successful. You have to listen to your customers and address their problems to make them happy.’ If you’ve been a part of any business, you’ve probably heard this mantra.

In recent years, customer retention has proven to be a better indicator of success than operational efficiency. A study from Harvard Business School shows that an increase in customer retention rates by only 5% will increase your revenue by 25-95%.

But how does insurance technology come into this?

A lot of insurers and even agencies are investing vast amounts of money in integrating big data analytics and intelligence into their business models. Big data allows you to use data processing models that store customer information and use it to map out their preferences.

There is a lot of potential for IoT and big data in the insurance industry. Many insurers are collaborating with companies like Vitality and Amazon to provide more tailored services to their customers. Chatbots and virtual assistants are also very popular for personalized real-time customer assistance.

IoT facilitates risk assessment to insurers in different markets by gathering data through devices like GPS car tracking devices, smart smoke alarms, and alarm systems to sell them personalized products.

The takeaway- The use of Big Data and IoT in insurance allows agents to find new customers in niche markets and retain existing ones by using customer data to provide personalized service.

Insurtech Trend 3: Digital Ecosystems

Ecosystems are customer-centric networks through which products and services are offered by various players.

Insurtech agencies now pose significant competition to insurers who are selling policies directly. Many insurers over the years have invested a substantial amount of capital in insurance technology for themselves. Despite this, the results have not turned out in their favor.

Carriers with Insurtech agency giving competition to carriers not using Insurtech agencies.

However, with careful analysis, collaboration, and integration, specialists believe that they can close the gap between insurers and Insurtech agencies.

According to worldInsurTechreport.com, 90% of Insurtech startups and 70% of Insurers agree with collaboration to develop a new ecosystem. Also, 96% of insurers do think that digital ecosystems are having an impact on the insurance industry.

Above all, Insurtech’s distinct aptitudes make incubators the perfect partner for nurturing a strong foundation in the marketplace. A lot of traditional insurance agencies might be uncertain about the road ahead.

It is high time for these agencies to either invest in insurance technology and innovation, partner with an Insurtech agency or just shut down their agencies for good.

Don’t panic; this will not happen immediately. But if you’re an agent and you want your career to grow, then this is the right time for you to hop in the train of insurance technology. It’s now or never.

The takeaway- Digital ecosystems are blooming – join the insurance technology wave before it’s too late.

Few best Insurance Memes of 2019

- Insurance is a cutthroat business.

Insurance Agents and The Mafia are very similar.

Why?

Both start their pitches with “That’s a nice family you got there. It’d be a shame for them if anything happened to you, wouldn’t it?”

- The woes of an insurance agent

Agent: “Thank you, Mr. Smith. I wish I had 15 more clients like you.”

Mr. Smith (surprised): “But why? I file a lot of claims and always pay premiums late.”

Agent: “I’d still like 15 clients like you. The issue is that I have 150 clients like you.”

- Getting creative with sales pitches

Life insurance agents to their clients: “It’s fine, don’t rush. You can sleep on it. If you wake up tomorrow, let me know what you decide.”

- The insurance business is diverse too!

How do insurance agents, underwriters, and actuaries drive?

The agent favors the accelerator, the underwriter favors the brakes, and the actuary decides the way forward by looking at the back window.

Author Bio

Ketan Vegad

I have been associated with PCI for the last five and half years. I am ALMI, ACS and CSM certified professional with 12+ years of experience as Managing Consultant and Software Testing Professional with rich experience in Life/Annuity Insurance, General Insurance, Property & Casualty Insurance Domain.